You're currently viewing this page in Thai. Click here to switch to English.

ลงทุนในธุรกิจ SME ไทย ผ่านหุ้นกู้คราวด์ฟันดิง

กับ Funding Societies

-

ลงทุนในหุ้นกู้รับผลตอบแทนที่ดีกว่าอย่างสม่ำเสมอ

-

กระจายความเสี่ยงในการลงทุน

-

เริ่มต้นลงทุนออนไลน์ ขั้นต่ำเพียง 10,000 บาท

ผลิตภัณฑ์นี้ให้บริการโดย บริษัท เอสเอฟ สยาม จำกัด ซึ่งเป็นผู้ให้บริการระบบคราวด์ฟันดิงที่ได้รับความเห็นชอบจากสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ก.ล.ต.)

หุ้นกู้คราวด์ฟันดิง เป็นหนึ่งในวิธีการหาเงินทุนเพื่อขยายกิจการของคุณ!!

ระดมทุนสำหรับโครงการและธุรกิจของคุณวันนี้เลย

หุ้นกู้คราวด์ฟันดิง คืออะไร?

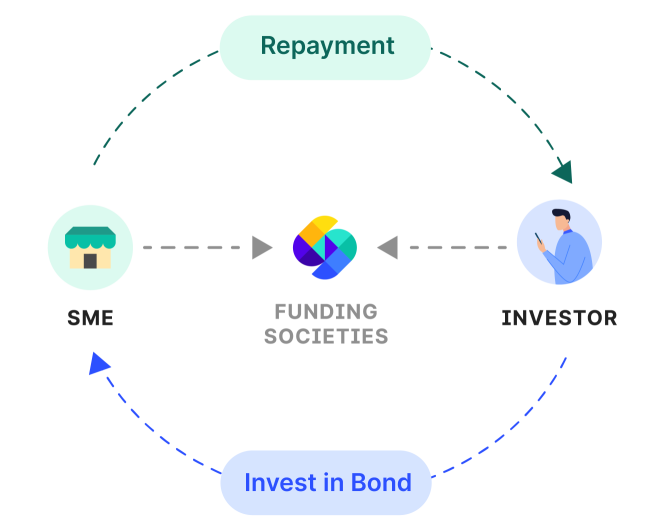

Debt Crowdfunding หรือ หุ้นกู้คราวด์ฟันดิง เป็นการลงทุนในรูปแบบหุ้นกู้ ที่ทั้งนักลงทุนรายบุคคลหรือสถาบันสามารถมาร่วมลงทุนในหุ้นกู้นั้น ๆ ได้ หุ้นกู้นี้จะออกโดย SME หรือ Startup ที่ต้องการเงินทุน ซึ่งจะพิเศษกว่าการระดมทุนทั่วไปที่เจ้าของกิจการยังสามารถรักษาความเป็นเจ้าของได้ จ่ายเพียงเงินต้นและดอกเบี้ยคล้ายกับการขอเงินทุนกับทางธนาคาร

เพียงแต่ธุรกิจ SME จะสามารถขอเงินทุนโดยไม่ต้องใช้หลักทรัพย์ค้ำประกันได้อย่างรวดเร็ว และง่ายดายในอัตราดอกเบี้ยที่เหมาะสม อีกทั้งนักลงทุนยังสามารถรับผลตอบแทนที่สูงกว่าเงินฝาก และสม่ำเสมอกว่าเมื่อเทียบกับหุ้นกู้ชนิดอื่น ๆ

การระดมทุนคราวด์ฟันดิงทำงานอย่างไร ?

ธุรกิจSMEสามารถสมัครเพื่อขอระดมทุนผ่านแพลตฟอร์มได้ โดยส่งเอกสารและข้อมูลเกี่ยวกับบริษัทให้เรา

เราจะดำเนินการประเมินเครดิต ความสามารถในการชำระคืน และความเสี่ยงจากแหล่งข้อมูลหลากหลายประเภท เมื่อธุรกิจผ่านการประเมิน เราจะทำการกำหนดอัตราดอกเบี้ยตามความเสี่ยง และปัจจัยต่าง ๆ ของธุรกิจนั้น ๆ

นักลงทุนสามารถเลือกลงทุนในหุ้นกู้คราวด์ฟันดิงได้อย่างหลากหลายเพื่อกระจายความเสี่ยง

ธุรกิจจะดำเนินการชำระคืนหุ้นกู้รายเดือน หรือชำระตอนครบกำหนดเพียงครั้งเดียว ขึ้นอยู่กับประเภทของการระดมทุนโดยผู้ออกหุ้นกู้จะชำระคืนทั้งเงินต้น และดอกเบี้ย

การชำระเงืนคืน

แบบรายเดือนหรือตามอายุหุ้นกู้

ระยะเวลาการลงทุน

ลงทุนระยะสั้น 1 - 12 เดือน

จำนวนเงินลงทุนขั้นต่ำ

ลงทุนออนไลน์เริ่มต้น 10,000 บาท

ทำไมต้องมีหุ้นกู้คราวด์ฟันดิงไว้ในพอร์ต?

กระจายความเสี่ยง และผลตอบแทนสม่ำเสมอ

แพลตฟอร์มที่ดีที่สุดสำหรับการเริ่มลงทุน

เหตุผลที่จะทำให้คุณหลงรักในการลงทุนผ่าน Funding Societies

เริ่มลงทุนหุ้นกู้ได้ง่าย

-

เราทำให้การลงทุนในหุ้นกู้ “คราวด์ฟันดิง”เข้าใจง่ายสำหรับทุกคน

-

จำนวนเงินลงทุน ขั้นต่ำ 10,000 บาท

-

ระยะเวลาลงทุนสูงสุด 1 ปี

-

ซื้อหุ้นกู้คราวด์ฟันดิงได้ง่าย ๆ ผ่านทางออนไลน์

ปกป้องผลประโยชน์ของนักลงทุน

-

เงินของนักลงทุนจะถูกเก็บไว้ในบัญชีควบคุม (Escrow Account) ที่ดูแลโดยผู้ดูแลสินทรัพย์ภายนอก (Escrow Agent) เพื่อให้มั่นใจว่าเงินจะถูกนำไปใช้ตรงตามวัตถุประสงค์

-

เราจะหักค่าธรรมเนียมจากนักลงทุนต่อเมื่อผู้ออกหุ้นกู้ชำระเงินจากการระดมทุนคราวด์ฟันดิงคืนสำเร็จเท่านั้น

-

จัดตั้งระบบติดตามหนี้ และประสานการดำเนินการทางกฎหมายให้แก่นักลงทุน

ประสบการณ์การลงทุนที่น่าประทับใจ

-

ได้ลงทุนในไทย ส่งเสริมการเติบโตของอุตสาหกรรม SME ไทย

-

ลงทะเบียน และเริ่มใช้งานเพื่อลงทุนออนไลน์ง่าย ๆ

-

ลงทุนซื้อหุ้นกู้ จ่ายเงิน และเรียกดูพอร์ตการลงทุนได้ทุกที่ ทุกเวลาผ่านแพลตฟอร์มลงทุนของเรา

-

มีผู้ช่วยการลงทุนพร้อมตอบทุกคำถามผ่าน LINE Official Account @fundingsocietiesth

ร่วมเป็นนักลงทุนกับเรา

ลงทุนในหุ้นกู้คราวด์ฟันดิงกับ Funding Societies ได้ง่าย ๆ ใน 4 ขั้นตอน

กระจายความเสี่ยงในพอร์ตของคุณด้วยการลงทุนในธุรกิจและสินทรัพย์ที่แปลกใหม่

ลงทะเบียน

-

กรอกข้อมูลส่วนตัวและอัปโหลดเอกสาร

-

ยืนยันความเสี่ยงที่รับได้และทำแบบสอบถามด้านการลงทุน

-

รอทางทีมงานตรวจสอบ

ค้นหาโอกาสการลงทุน

-

ศึกษาข้อมูลเกี่ยวกับบริษัท สถานะทางการเงิน และการประเมินความเสี่ยงทางเครดิตผ่าน factsheet

-

สอบถามข้อมูลเพิ่มเติมได้จากทีมงานตลอดระยะเวลาก่อนและหลังการระดมทุ

เริ่มลงทุน

-

ตัดสินใจลงทุนตามระดับความเสี่ยงของคุณ

-

โอนเงินเข้าบัญชีควบคุมที่ดูแลโดยเครือข่ายภายนอกของเราเพื่อยืนยันการลงทุน

ติดตามการลงทุนและผลตอบแทน

-

เข้าถึงข้อมูลการลงทุนและประวัติการทำธุรกรรมของคุณ

-

ติดตามผลดำเนินการของพอร์ตการลงทุนของคุณ

ผลิตภัณฑ์การลงทุนของเรา

หุ้นกู้คราวด์ฟันดิง

จากใบแจ้งหนี้การค้า (อินวอยซ์)

-

ให้เงินทุนแก่ SME ที่มีใบแจ้งหนี้จากองค์กรขนาดใหญ่ ให้ SME มีเงินทุนหมุนเวียนก่อนถึงวันกำหนดชำระเงิน

-

ชำระเงินต้นและดอกเบี้ยครั้งเดียว

หุ้นกู้คราวด์ฟันดิง

จากเงินทุนระยะสั้น

-

ให้เงินทุนแก่ SME เพื่อเป็นทุนหมุนเวียนอเนกประสงค์

-

ชำระเงินต้นและดอกเบี้ยรายเดือน

หุ้นกู้คราวด์ฟันดิง

จากใบสั่งซื้อ

-

ให้เงินทุนแก่ SME ที่มีใบสั่งซื้อจากซัพพลายเออร์ให้ SME มีเงินชำระค่าสินค้าเพื่อผลิตสินค้าตามออร์เดอร์

-

ชำระเงินต้นและดอกเบี้ยครั้งเดียว

ร่วมเป็นส่วนหนึ่งในชุมชนนักลงทุนของเรา

"Funding Societies ทำให้เราเปิดใจลงทุนระยะสั้นกับหุ้นกู้ และเพราะการจ่ายผลตอบแทนคืนทุกเดือน เปิดโอกาสให้เราได้นำเงินที่นอนอยู่ในบัญชีไปลงทุนเพื่อให้ได้มากกว่าเดิม"

รศนา ปัญญาวรรณ, Innovative Credit Product Manager

"Funding Societies เป็นแพลตฟอร์มที่ช่วยเปิดโอกาสเพิ่มทางเลือกทางการลงทุนสำหรับนักลงทุน สร้างผลตอบแทนในระดับเหมาะสม และสม่ำเสมอ นอกจากนั้นยังช่วยให้ SME เข้าถึงการระดมทุนคราวด์ฟันดิงที่สะดวกขึ้น เสริมสร้างการพัฒนาธุรกิจของ SME ให้เติบโตต่อไปได้ดี"

นิติ สนิวาล, Investment Consultant

(Complex Type 1)

คำถามที่พบบ่อย

-

Funding Societies มีใบอนุญาตในไทยหรือไม่?

Funding Societies คือหนึ่งในแพลตฟอร์มการระดมทุนหุ้นกู้แห่งแรก ๆ ที่ได้รับความเห็นชอบจากสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ก.ล.ต.) ประเทศไทย

นอกจากนี้ Funding Societies ยังได้รับใบอนุญาตทั้งในประเทศสิงคโปร์ มาเลเซีย และอินโดนีเซียอีกด้วย -

ใครสามารถลงทุนในหุ้นกู้กับ Funding Societies ได้บ้าง ?

ทุกท่านสามารถร่วมลงทุนกับเราได้ โดยทางเราแบ่งนักลงทุนเป็น 3 ประเภท :

1. นักลงทุนทั่วไป

- ผู้สมัครที่สนใจการลงทุนในหุ้นกู้คราวด์ฟันดิง จะต้องมีอายุตั้งแต่ 21 ปีขึ้นไป

2. นักลงทุนรายใหญ่ (High Net Worth Investor)

- นักลงทุนที่มีรายได้ต่อปี ตั้งแต่ 3 ล้านบาทขึ้นไป

- นักลงทุนที่มีพอร์ตลงทุนในหลักทรัพย์ตั้งแต่ 8 ล้านบาทขึ้นไป ถ้ารวมเงินฝากจะเป็น 15 ล้านบาทขึ้นไป

- นักลงทุนที่มีสินทรัพย์สุทธิตั้งแต่ 30 ล้านบาทขึ้นไป ไม่รวมมูลค่าอสังหาริมทรัพย์ที่ใช้เป็นที่พักอาศัย

- มีวุฒิบัตรรับรองความสามารถจากหลักสูตร CFA, CISA, CAIA และ CFP (อย่างใดอย่างหนึ่ง)

3. นักลงทุนสถาบัน

สำหรับนักลงทุนสถาบัน โปรดติดต่อทางเราโดยตรงผ่านอีเมล ([email protected]) หรือ LINE ID @fundingsocietiesth

ข้อควรทราบ: เรามีการทำ KYC (ทำความรู้จักลูกค้า) ผู้สมัครเป็นนักลงทุนทุกคน ก่อนที่จะอนุมัติให้เริ่มลงทุนกับเราได้

-

Funding Societies มีค่าธรรมเนียมการให้บริการหรือไม่?

Funding Societies มีค่าธรรมเนียมการดำเนินการบนแพลตฟอร์ม เพียงแต่จะหักค่าธรรมเนียมต่อเมื่อผู้ออกหุ้นกู้ชำระเงินคืนแล้วเท่านั้น

-

มีจำนวนเงินลงทุนขั้นต่ำหรือสูงสุดหรือไม่?

จำนวนเงินที่นักลงทุนสามารถลงทุนได้จะแตกต่างไปตามประเภทของนักลงทุน ซึ่งจะแบ่งออกเป็น 2 ประเภท:

1. นักลงทุนทั่วไป (Retail Investor)

- การลงทุนขั้นต่ำอยู่ที่ 1,000 บาทต่อหนึ่งหุ้นกู้

- การลงทุนสูงสุดอยู่ที่ 100,000 บาทต่อหนึ่งหุ้นกู้ และไม่เกิน 1 ล้านบาทต่อปี ต่อแพลตฟอร์ม

2.นักลงทุนที่ไม่ใช่รายย่อย (Non-retail investor) ได้แก่ นักลงทุนสถาบัน (Institutional Investor) นักลงทุนใหญ่ (High Net Worth Investor) และนักลงทุนรายใหญ่พิเศษ (Ultra High Net Worth Investor)

- การลงทุนขั้นต่ำอยู่ที่ 1,000 บาทต่อหนึ่งหุ้นกู้

- สามารถลงทุนได้ไม่จำกัด

-

เมื่อไหร่จึงจะได้รับเงินคืนหลังจากยกเลิกการลงทุนหรือการระดมทุนไม่สำเร็จ?

Funding Societies จะจ่ายเงินคืนให้ภายใน 7 วันทำการ หลังจากนักลงทุนยกเลิกการลงทุนหรือการระดมทุนไม่สำเร็จ

-

ต้องทำอย่างไรหากผู้ประกอบกิจการไม่คืนเงิน?

Funding Societies จะแจ้งนักลงทุนหากมีการจ่ายเงินล่าช้าหรือผิดสัญญาการชำระหนี้ ในขั้นแรกของการทวงหนี้ Funding Societies จะส่งคำเตือนไปหาผู้ประกอบกิจการ อย่างไรก็ตาม หากขั้นตอนนี้ไม่สำเร็จ ทางเราจะจ้างหน่วยงานการติดตามหนี้และประสานที่ปรึกษาทางกฎหมายเพื่อดำเนินการเรียกคืนหนี้ในนามของนักลงทุน

-

Funding Societies ประเมินกิจการต่าง ๆ ที่ขอออกหุ้นกู้อย่างไร?

Funding Societies ประเมินกิจการต่าง ๆ โดยกระบวนการประเมินเครดิต และมีการให้คะแนนความเสี่ยงที่ครอบคลุมรอบด้าน เราประเมินทั้งการประกอบกิจการของบริษัท และผู้ถือหุ้นหลัก โดยดูจากองค์ประกอบข้อมูลที่หลากหลาย เช่น โอกาสโดยรวมของบริษัท อุตสาหกรรม และเศรษฐกิจ รายการเดินบัญชีทางการเงิน กระแสเงินสด ประวัติเครดิต ประวัติคดีความ และอื่นๆ

นอกจากนี้ Funding Societies ยังมีการตรวจเยี่ยมสถานประกอบกิจการเพื่อให้มั่นใจว่ายังคงมีการดำเนินกิจการอยู่ และมีการทำ KYC (ทำความรู้จักลูกค้า) อย่างครอบคลุม เพื่อตรวจสอบตัวตนผู้ถือหุ้นและผู้บริหาร

คะแนนเครดิตและเกรดจะถูกกำหนดขึ้นสำหรับกิจการแต่ละแห่ง โดยประเมินจากความเสี่ยงต่างๆ -

ต้องใช้เอกสารอะไรบ้างสำหรับการเปิดบัญชีเพื่อซื้อหุ้นกู้กับ Funding Societies ?

เอกสารที่จำเป็นในขั้นตอน KYC (ทำความรู้จักลูกค้า) ประกอบด้วย:

1. สำเนาบัตรประจำตัวประชาชน หรือหนังสือเดินทาง

2. สำเนาบัญชีธนาคาร หรือรายการเดินบัญชีธนาคาร

3. หลักฐานแสดงคุณสมบัตินักลงทุน (นักลงทุนรายใหญ่)

ลงทุนในไทย ผ่านธุรกิจ SME และได้รับผลตอบแทนที่ดีกว่า

Indonesia

Pendana

[email protected]

+62 877 3751 1114

Peminjam

[email protected]

+62 877 7873 6144

Penagihan

[email protected]

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

[email protected]

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

108 Robinson Road

#06-01

Singapore 068900

Malaysia

[email protected]

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Thailand

SME Loan

[email protected]

+66 93 139 9721

Investment

[email protected]

+66 62 197 8661

No. 29, Vanissa Building,

24th Floor, Room No. 2412 & 2414,

Soi Chidlom, Ploenchit Road,

Lumpini, Pathumwan,

Bangkok, 10330

Vietnam

[email protected]

(+84) 28 7109 7896

The Sarus Building

67 Nguyen Thi Minh Khai, Ben Thanh Ward, District 1, Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward, Dong Da District,

Hanoi, Vietnam

ขอเงินทุน

ลงทุน

เกี่ยวกับเรา

สื่อมวลชล

-

Singapore

-

Indonesia

-

Malaysia

-

Thailand

-

Vietnam

Funding Societies เป็นแพลตฟอร์มเงินทุนดิจิทัลชั้นนำในเอเชียตะวันออกเฉียงใต้ โดยเราเชี่ยวชาญในการจัดหาเงินทุนระยะสั้นสำหรับ SME ในหลายรูปแบบซึ่งเราได้รับเงินทุนจากทั้งนักลงทุนรายบุคคลและนักลงทุนสถาบันเพื่อประกอบธุรกิจ โดยเราภูมิใจในความรวดเร็วและความยืดหยุ่นของเราในการให้เงินทุนแก่ SMEs ด้วยการสนับสนุนจากนักลงทุนชั้นนำของโลกอย่าง เช่น SoftBank Ventures และ Sequoia India ทั้งนี้ เราได้จัดหาเงินทุนให้ SME ไปมากกว่า 80,000 รายทั่วทั้งภูมิภาค ด้วยจุดมุ่งหมายที่จะที่แก้ไขปัญหาช่องว่างทางการเงินและเป็นตัวกลางในการสร้างโอกาสทางการเงินสำหรับ SME เพราะเราเชื่อว่า SME เป็นแกนหลักสำคัญของเศรษฐกิจไทย

บริษัท เอฟเอส สยาม จำกัด และ บริษัท เอฟเอส แคปปิตอล จำกัด ล้วนเป็นส่วนหนึ่งของแบรนด์ Funding Societies

บริษัท เอฟเอส สยาม จำกัด (เลขทะเบียนนิติบุคคล: 0105563070599) ที่อยู่ เลขที่ 29 อาคารวานิสสา ชั้น 24ห้องเลขที่ 2412 ซอยชิดลม ถนนเพลินจิต แขวงลุมพินี เขตปทุมวัน กรุงเทพมหานคร 10330 เป็นผู้ให้บริการระบบคราวด์ฟันดิงที่ได้รับความเห็นชอบจากสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ก.ล.ต.)

สามารถตรวจสอบการได้รับความเห็นชอบของเราได้ที่ https://market.sec.or.th/LicenseCheck/Search

บริษัท เอฟเอส แคปปิตอล จำกัด (เลขทะเบียนนิติบุคคล: 0105564064304) ที่อยู่ เลขที่ 29 อาคารวานิสสา ชั้น 24ห้องเลขที่ 2414 ซอยชิดลม ถนนเพลินจิต แขวงลุมพินี เขตปทุมวัน กรุงเทพมหานคร 10330 เป็นบริษัทที่ดำเนินธุรกิจในการให้เงินทุนแก่ SME ที่มีคุณสมบัติครบถ้วน