ขณะนี้คุณกำลังดูเว็บไซต์นี้ในรูปแบบภาษาอังกฤษ กรุณากดตรงนี้เพื่อดูในรูปแบบภาษาไทย

Invest in Crowdfunding

with Funding Societies

-

Regulated by SEC

-

Minimum investment amount with only THB 10,000

-

Earn better fixed-income returns

-

A new access to capital for SME

Debt Crowdfunding is offered by FS Siam Co., Ltd

Crowdfunding is a great way for financing the growth of your business!!

Raise funds for your projects and initiatives today

What is Debt Crowdfunding?

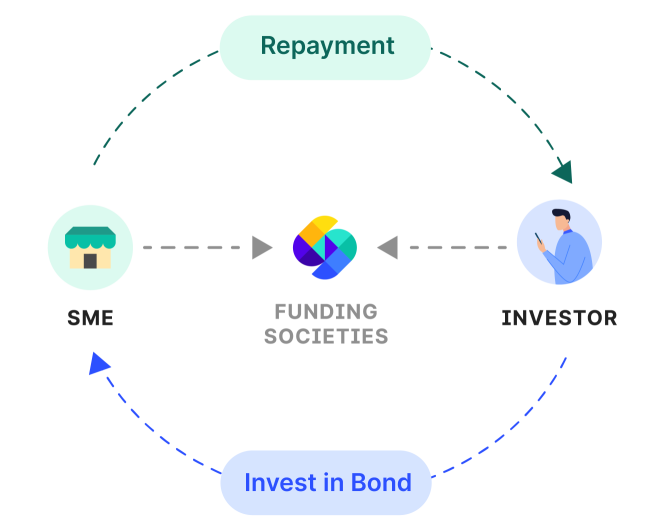

Our debt crowdfunding platform is a funding marketplace which connects businesses seeking funds directly with investors looking for fixed income returns. For investors, this is often an attractive investment option as it offers high returns compared to other type of debt investments. Businesses are able to get access to quick funding, at reasonable rates of interest, without needing to put up collateral.

How Debt Crowdfunding works

An eligible business applies for business financing by submitting the required documents.

Our credit and risk teams review each application objectively and fairly.

Our established investor network crowdfunds the business on the platform.

After crowdfunding, the funds get disbursed to the business immediately.

Repayment

Monthly/periodic repayment

Investment Period

1 - 12 Months

Minimum Investment Amount

THB 10,000

Why diversify your portfolio with FS?

High liquidity with relatively higher return

The best place to start investing

Here are a few reasons why you will love investing with Funding Societies

Low barrier to entry

-

We make investment easy for you to understand.

-

Investment starts from a minimum of THB 10,000

-

Tenor up to 1 year

Looking out to protect your interests

-

Investor's money is kept in a control account (Escrow Account) managed by a third-party trustee (Escrow Agent)to give our investors peace of mind.

-

Funding Societies charge a platform administration fee to all investors upon successful repayment only.

-

Deploy a debt collection system and coordinate legal actions for investors

Seamless investor experience

-

Online registration and activation

-

Invest, pay and review your portfolio anywhere any time on our platform

-

Assist your investment decision via Line Official Account @fundingsocietiesth

Be an Investor Today

Investing with Funding Societies in 4 steps

Account registration

-

Fill in personal information and upload your documents

-

Verify your risk profile and investment knowledge

-

Verification from our team

Discover investment opportunities

-

Review factsheet to get more information on company, financial performance, and credit risk assessment

-

Ask business owners and chat with other investors through Investor Forum

Start investing

-

Choose investment opportunities based on your risk appetite

-

Deposit money with our third-party control account to confirm your investment

Track your investment & return

-

Access your investment details and transaction history

-

Track your portfolio performance

Types of Investment Products

Invoice Financing Crowdfunding

-

Invest into financing backed by invoices from big corporates

-

Bullet repayments

Business Term Financing Crowdfunding

-

Invest into business term financing that can be used as working capital

-

Monthly repayment

PO Financing

Crowdfunding

-

Invest in PO financing that involves big corporate

-

Bullet repayment

Join our Investor community

“Funding Societies made me open up to investing in crowdfunding bonds. And the monthly return gives me the opportunity to invest more”

Rasana Punyawan, Innovative Credit Product Manager

"Funding Societies is a platform that provides investors with more investment options. generate returns at a reasonable and consistent level. Also helps SMEs more convenient access to fundraising and enhance their business development to continue growing well."

Niti Sanivarl, Investment Consultant

(Complex Type 1)

Frequently Asked Questions

-

Is Funding Societies licensed in Thailand?

Funding Societies is one of the first debt-crowdfunding platforms to obtain a crowdfunding license issued by the Securities and Exchange Commission, Thailand (SEC).

In addition, Funding Societies is licensed in Singapore, Malaysia and Indonesia.

-

Who can invest with Funding Societies?

All individuals are welcome to invest with us. There are 3 types of investors ;

1. Retail Investors

- Investors who are interested in investing in crowdfunding bonds. Must be at least 21 years of age

2. Qualified Investors (High Net Worth)

- Investors with an annual income of at least 3 million baht

- Investors with portfolios investing in securities at least 8 million baht.

If the deposit is included, it will be 15 million or more.- Investors with net assets of 30 million baht or more, not including the value of real estate used as a residence.

3. Institutional Investors

- For institutional investors, please contact us directly via email.

([email protected]) or Line ID @fundingsocietiesthNote : there is a KYC (Know-Your-Customer) process that all investors must go through before being approved to invest on our platform.

-

Does Funding Societies charge a service fee?

Funding Societies charge a platform administration fee to all investors upon successful repayment only.

-

Is there a minimum or maximum investment amount?

The amount of money that investors can invest varies vary according to the type of investors which can be broadly divided into two:

1. Retail Investor

- Minimum investment limit is THB 1,000 per crowdfunding bond

- Maximum investment limit is THB 100,000 per crowdfunding bond and THB 1 Million in 12-months period in crowdfunding bonds across any crowdfunding platform

2. Non-retail investor (qualification investor, institutional investor and VC or PE)

- Minimum investment limit is THB 1,000 per crowdfunding bond

- No maximum investment limit

-

When will I get my refund after cancelling investment or unsuccessful crowdfunding?

Funding Societies will process investor's re-fund within 7 days after investor cancels investment or crowdfunding becomes unsuccessful.

-

What should I do if an issuer does not repay?

Funding Societies will inform Investors whenever there is a late repayment or default. At the initial stage of collection, Funding Societies will send reminder to issuer. However, if the approach is unsuccessful, we will hire a debt collection agency and partnered law firms to carry out debt collection on the investor's behalf.

-

How does Funding Societies assess issuers?

Funding Societies assess issuer by following a comprehensive credit assessment and risk scoring approach. We assess both the issuer's company and main shareholders by looking various data points e.g. overall prospect of the company, industry and economy; financial statement; cashflow, credit history; litigation history; etc...

In addition, Funding Societies also perform site-visit on issuer to confirm that the company is still in operation; and do comprehensive KYC (Know-Your-Customer) to check shareholder's and director's identities.

Depending on the risk, credit score and grade will be assigned to individual issuer.

-

What documents do we ask for?

Document Verification for KYC (Know Your Customer) process:

1. Identification Document (National ID for Thai / Passport for Foreigner)

2. Selfie with Identification Document - Investor's face match facial on National ID

3. Front Page of Bank Book / Bank Statement - Bank Name, Branch, Account Name, Account No.

4. Proofs of Investor Qualification (Accredited investor)